Changes to the Financial Promotion Order Exemptions

The new rules for high net worth individuals (“HNWI”) and self-certified sophisticated investors will come into effect on 31 January 2024 with no transitionary period. We believe that these changes will have a detrimental effect on the early-stage ecosystem, especially women and those from under-represented groups

What can you do?

Startup Coalition has written an open letter to the Chancellor to urge a reversal of these changes. UKBAA, along with Alma Angels, Extend Ventures and The Entrepreneurs Network, have shown our support and we encourage you to read the open letter and sign it to show your support.

Get up to date

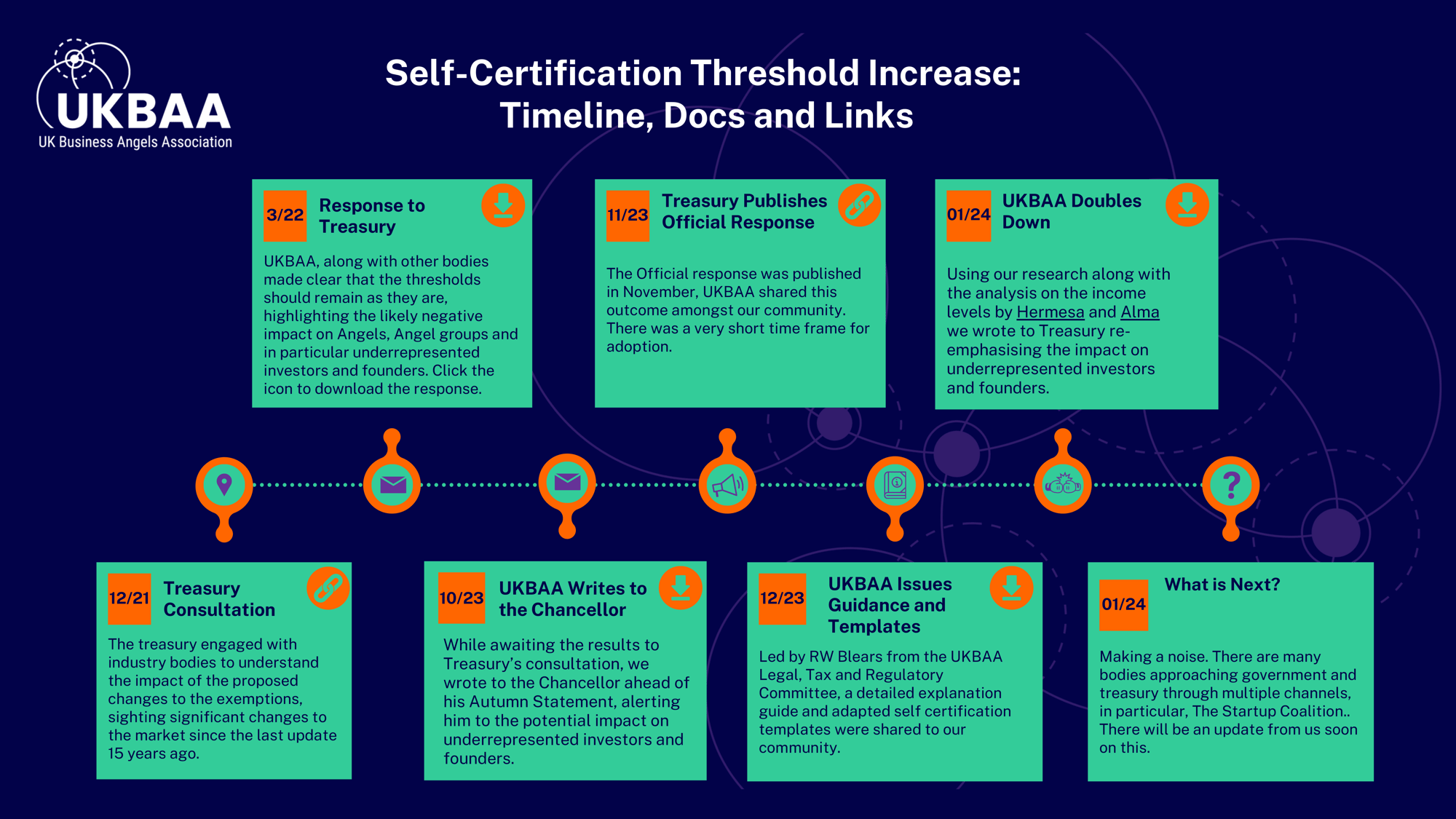

If you want to find out more information about the changes, and how they will affect you, take a look at our timeline, which contains links to key documentation.

Watch the webinar

UKBAA in partnership with RW Blears held a webinar recently to go through all of the changes for self-certified investors, and to answer your questions. You can watch the full webinar now and make sure you understand all of the information and how it's applicable to you.

FAQs prepared by

To help you understand the new changes and how they affect you, please see our FAQs below, compiled by Ollie Blears and Frank Daly from RW Blears. Ollie is also a part of the UKBAA Legal, Tax and Regulatory Committee:

1. For investors who do not qualify but still choose to invest – what are the repercussions?

The restriction is not on investors. It is on communicators of promotions to engage in investment activity who make those communications in the course of business. If there are repercussions, they will be on the person sending the communication to people not permitted to receive it.

If reasonable steps are taken by the communicator to ensure those people do not receive it, but they come upon it anyway, there should be no repercussions. If communicators are careless, reckless or wilful in their breach, the legislation allows for them to be fined or, in egregious cases, imprisoned.

2. Does this impact founders and their ability to raise investment?

Yes.

But, in order to raise investment, a founder needs to describe their company and their share offering in a promotional document (e.g. a pitch deck). The law restricts the dissemination of such "financial promotions" unless they are either (a) approved by a FCA authorised firm or (b) exempt from the restriction because they are only sent to certain individuals (and include appropriate prescribed language such as a risk warning).

The most relevant exempt categories of recipient are (self) certified high net worth individuals and (self) certified sophisticated investors.

It is these categories (and the forms of the relevant certificates) that are changing and the changes will mean that fewer people fall into these categories from 31 January 2024.

Accordingly, there will be logically fewer people a founder can raise money from (using unapproved promotional documents) once the new rules come into force.

3. If anyone self-certifies now, does that certification still last for 12 months from that date?

No.

If someone signs the old style of certificate now, that will not allow them to receive unapproved financial promotions from 31 January 2024 onwards unless they have signed the new style of certificate.

One exception to this is where a financial promotion has been made in compliance with the existing regime before 31 January 2024, any follow up financial promotions relating to the same investment which are made within 12 months of the first communication to the same recipients do not require those recipients to have signed updated investor certificates.

4. Do all existing, signed certificates need to be re-signed before the 31st of January or are they still valid?

Existing, signed certificates which have been signed less than 12 months previously will be valid until 30 January 2024 but will cease to be valid in respect of promotions received thereafter.

5. If anyone falls below the new thresholds but above the old thresholds, should I get them to self-certify before the 1st of Feb?

Unfortunately, this would not allow them to receive unapproved promotions from 31 January 2024.

6. Do 'Restricted Investors' qualify as angel investors?

We believe this question is asking whether a person who is able to certify as a 'restricted investor' can receive unapproved promotions after the new rules come in on 31 January.

The answer to this is 'no'.

'Restricted investor' is not a third category of eligible recipient of unapproved exempt promotions (alongside high net worth individuals and sophisticated investors).

'Restricted investors' are not currently permitted to receive unapproved promotions, and this is not changing on 31 January.

The concept of a 'restricted investor' only appears in the FCA rules which apply to FCA authorised firms. It does not appear in the Financial Promotion Order (either in its current form or as it will be post the amendments coming in on 31 January).

A 'restricted investor' in the FCA rules is merely a particular category of person who (provided a number of other hurdles are met) is able to receive a direct offer financial promotion for a non-readily realisable security which has been approved by an FCA authorised firm. The concept is most helpful in allowing ordinary members of public to invest in unquoted companies via crowdfunding platforms.

As such, the concept of a 'restricted investor' is likely to be of no relevance to non-FCA authorised angel syndicates.

7. As the new self-certification requires the individual's Net Worth be given, where is that stored and what will it be used for?

When using the new HNWI investor statement, a figure is required to be entered for either the investor's (i) annual income in the last financial year (rounded to the nearest £10,000) or (ii) net assets (rounded to the nearest £100,000).

The requirement on someone communicating a financial promotion is that they have a “reasonable belief” that the recipient has signed such a certificate – the most reliable way of obtaining that belief being to request sight of the signed certificate.

There is no specific requirement on the communicator to retain the information provided and certainty not to "use it" for any other purpose. However, a coordinator of an angel syndicate, for instance, may well wish to keep on file an up to date (i.e. less than 12 months old) completed and signed certificate on behalf of each member for their own compliance records to evidence that none of the financial promotions they circulate have been circulated in breach of FSMA and the Financial Promotion Orders.

8. When a new member is recruited to an angel group who doesn't meet the HNW criteria or any of the SI criteria but is waiting to qualify under the "being a member of an angel group for 6 months" head, what can they do? How can we educate them without breaching the Fin Prom exemptions?

An approach which could be recommended is for business angel syndicates and networks to consider offering a “non-participation/viewing only” membership category to new members whereby they are able to view the investment opportunities presented to the syndicate, but not invest.

The general prohibition (s21 of FSMA 2000) provides that “a person must not, in the course of business, communicate an invitation or inducement to engage in investment activity…unless the promotion has been made or approved by an authorised person or it is exempt”.

If a new member is unable to engage in investment activity due to restrictions applied by the syndicate then it follows that insofar as they are concerned they have not received a financial promotion.

After six months of membership then so long as they (and the syndicate lead(s) are happy for the individual to move to full participatory membership (and sign a sophisticated investor statement which confirms that they have been a member of an angel network for at least six months), then it should be open for them to do so.

Overall, this feels a responsible approach to introducing new investors to angel investment rather than simply blocking their involvement (perhaps indefinitely if they never satisfy other conditions) or rushing them straight into active investing with an onboarding process which fails to properly review the basis on which applicants have completed the investor statements.

9. How can we be sure that the lead of an angel group will not be prosecuted if a new angel (under the 6 months' membership threshold) invests in a business, despite being told that they are not allowed to?

It is worth noting that the rules do not prevent investments being made by certain people – they penalise persons who communicate invitations or inducements to engage in that activity. To an extent, therefore, it is in the power of the communicator to determine what they are communicating.

If the angel syndicate has a known allocation to an investment, then it should (generally speaking) be relatively straightforward to identify who within the round is participating as part of that syndicate, and it is unlikely (outside of separate solicitation by the company) that a member of an angel network who is not eligible to invest subsequently succeeds in investing.

10. What changes to communications need to be made? Segmenting your angel base between those that are "certified" and "non-certified" so that promotions aren't made to the non-certified? Are there other comms process changes that we should consider?

The forms of the HWNI and SI certificates are changing and so are the tests applied to determine whether a person falls into those categories. No other material changes are being made.

What angel groups need to do is circulate the new certificates to their membership and request at least one of these be completed, signed and returned by all those who meet the new criteria.

Those that are unable to sign one or other form should no longer be sent invitations or inducements to engage in investment activity. Logically, the only people who should fall into that category are persons who have been members for less than six months (and who don't meet the criteria in some other way). As regards those persons, and new applicants who also don't meet the criteria in some other way, please see previous questions (including Q3 above).

11. Who actually audits the record keeping of self-certification?

The rules penalise persons who communicate financial promotions in breach of the restrictions. It follows that whoever is sending the promotional material should be motivated to ensure they are doing so without breaching the restrictions. It follows that they might wish to ensure they have logged the receipt of signed certificates for each recipient, just in case they were challenged by, for instance, the FCA as to how they obtained a reasonable belief that all the recipients were certified as exempt.

There are no complicated (or even simple) rules about auditing/record keeping set out in the Financial Promotion Order. It simply says that an offence is committed by a person who communicates a financial promotion which is unapproved by an FCA firm where they lack a reasonable belief that the recipient is an eligible, exempt recipient.

12. How long do you have to keep the records of the self-certification is it just annually or would you be expected to produce records going back 7 years?

There is no specific requirement even to keep records, let alone keep them for any length of time. Clearly, the longer some form of record is kept, the longer one has a robust defence to any challenge. However, it would not amount to a breach of any rule if the records were destroyed five minutes after the communication was made.

Practically speaking, we would expect angel groups to ask their membership to sign fresh certificates once every 12 months (as this is how long they last) and to keep each freshly signed certificate on file until such time as it is replaced 12 months hence.

13. I would like to understand more about the promotion of pitch events through email and social media and what the guidance now is with respect to the risk warning and disclaimer. In our specific situation, pitch details are anonymised and only a summary/teaser of the pitch is included in any promotion, advert or booking. It is not until the event that we share full details.

Social media is accessible to everyone, so it is not possible to rely on the exemptions for high net worth individuals and sophisticated investors. Accordingly, social media posts must either (a) fall short of amounting to an invitation or inducement to engagement in investment activity or (b) be approved by an authorised person and carry the FCA mandated risk warnings.

Where what one is promoting is a "pitch event" rather than a specific investment, this may well fall short of an invitation to engage in investment activity. If that was the case, there is no mandated risk warning that needs to be applied although a prudent angel lead might wish to include some generic language reminding readers that the investments to be pitched on the day will involve risk and that they should take such advice as they need (as none is given by the angel).

14. A number of groups are encouraging investors to self-certify as Professional, rather than HNW or Sophisticated. How does the panel feel about the likelihood of that practice continuing?

This is not a solution and doesn't really make sense in this context. It may be that there is some confusion here because there are certain relaxations in the FCA Handbook regarding approved promotions made to professional (as opposed to retail) clients of authorised firms.

To recap, there are two potentially relevant concepts of what amounts to a "professional". One is within the FCA rules – a "professional client of an authorised firm". This is unlikely to be relevant in the context of angel groups or unapproved financial promotions. A person is not able to receive unapproved financial promotions merely by virtue of being a professional client of an authorised firm.

The other is within the Financial Promotion Order – an "investment professional". This is an exempt category, and persons in it are able to receive unapproved promotions. However, the definition is narrow and would exclude the vast majority of angel investors as it is restricted, in brief, to those who work in the financial sector (i.e. FCA authorised persons and their equivalents, government bodies etc).

15. Is the form incomplete if it is signed but boxes are not detailed?

Yes, the detail is the principal change in the updates.

16. Will investors need to show proof of their income / assets?

No, although this additional step was proposed in the initial consultation it has not been taken forward on account of being overly onerous and data sensitive.

17. Are there any other relevant FPO exemptions to be aware of?

Promotions made to overseas persons are exempt, so long as such promotions are not also shared with other UK recipients who would not already benefit from an exemption (such as HNWI or sophisticated investors).

One-off promotions (which are either non-real time or are solicited real time communications) which are made either only to one recipient or to a group of recipients in the expectation that they act jointly are also exempted, so long as (i) the communication is not part of an organised marketing campaign and (ii) the identity of the product or service to which the communication relates has been determined having regard to the particular circumstances of the recipient. In practice, this is a relatively niche exemption to rely on defensibly, and we would recommend seeking legal advice first as to whether this is compatible with your individual scenario.

Finally, it’s worth noting that in order for a financial promotion to be caught by the rules, it must be made “in the course of business” (i.e. which requires commercial intent on behalf of the communicator).

FCA guidance has confirmed that where a fundraising company is already in operation it will always be acting ‘in the course of business’ when seeking to generate fundraising (whether directly or indirectly).

However, at the pre-formation (“pre-seed”) stage, it will often be the case that individuals who are proposing to run the company will approach a small number of friends, relatives and acquaintances to see if they are willing to provide start-up capital. In the FCA’s view, such individuals will not be acting ‘in the course of business’ during this pre-formation stage and so any investment promotion in this scenario should not be caught.